Home » Industries » Banking & Financial Services » Banking » Innovation expedites pandemic relief

Overcoming the hurdle — legacy infrastructure

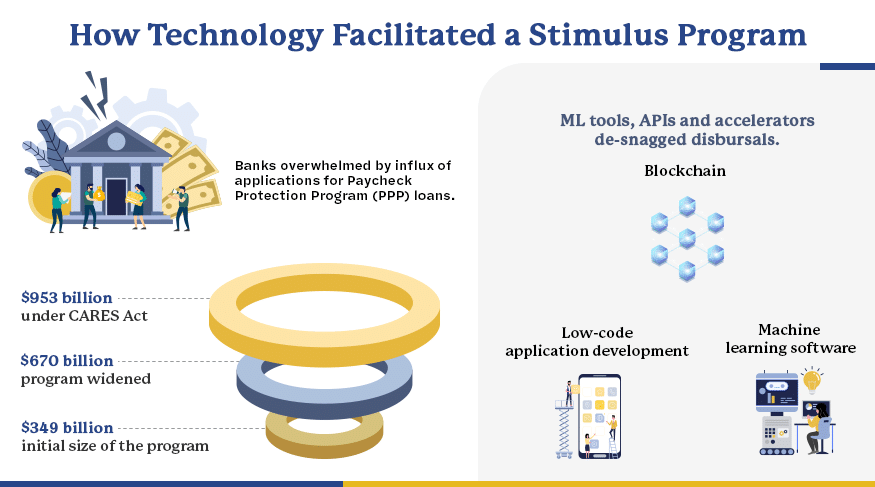

Technology service providers met the challenges on multiple fronts. For instance, blockchain technology, low-code application development platforms like Appian and Mendix and machine learning software were linked to loan origination systems. They integrated the SBA’s processes with API-based systems, which the agency lacked at the time.

The low-code applications defined the process in visual programming, like a workflow, and then it automatically could detect various cascading or impacted systems. Bank systems could then intervene as needed, such as in fetching and feeding additional information. They could create an integrated view of the entire process, and across the banking system.

While the first month was all about manual processing of loan applications, within weeks, technology providers started coming up with accelerators to do the visual programming in the front end, with API-based adaptors in the middleware.

All that helped banks smoothen the path for onboarding borrowers, mapping out their needs and establishing their creditworthiness. The system also helped ascertain new behaviors that prevented fraudulent applications in the system.

Key takeaways

- Disbursing PPP loans to small businesses in short order overwhelmed the banking system.

- ML-based software, low-code development platforms and API-based systems cleared snags.

- The innovation streamlined borrowers' creditworthiness and onboarding, and prevented fraud.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touch