Home » Industries » Insurance Technology Services » Value We Provide

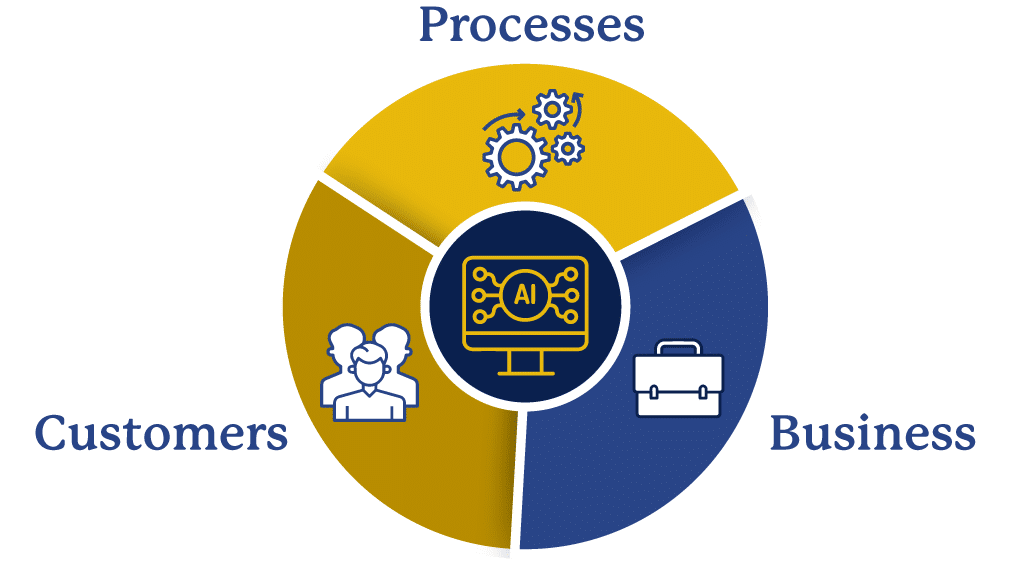

What Makes Iris Different

Iris follows a “Customer First” principle, which is etched permanently in the way we deliver InsurTech services ranging from consulting to managed services to transform digitally. We enable our clients’ digital transformation journeys with innovative solutions, indigenous frameworks, and accelerators. Our services help insurers deliver exceptional services to their customers and capitalize on opportunities through focused and personalized outreach.

Iris helps organizations grow and diversify their offerings to meet scaled business needs, including customer experience, sustainability, and security. We leverage Cloud, Data & Analytics, and Automation technologies to build resilient InsurTech solutions. Our services have significantly impacted technological advancement for leading global insurers and helped them drive successful digital transformation journeys.

Faster Time-to-Market

Unparalleled Customer Experience

Reduced Operating Costs

While not always the case, typically, insurers have the opportunity to reduce operating costs by reducing or eliminating hardware, licensing, and maintenance costs. Further, with automation, key areas such as customer onboarding, underwriting, and claims management can be streamlined and provide a better customer experience with greater efficiency and reduction in costs and timelines. All indispensable prerequisites when it comes to client acquisition and retention in today’s competitive environment.

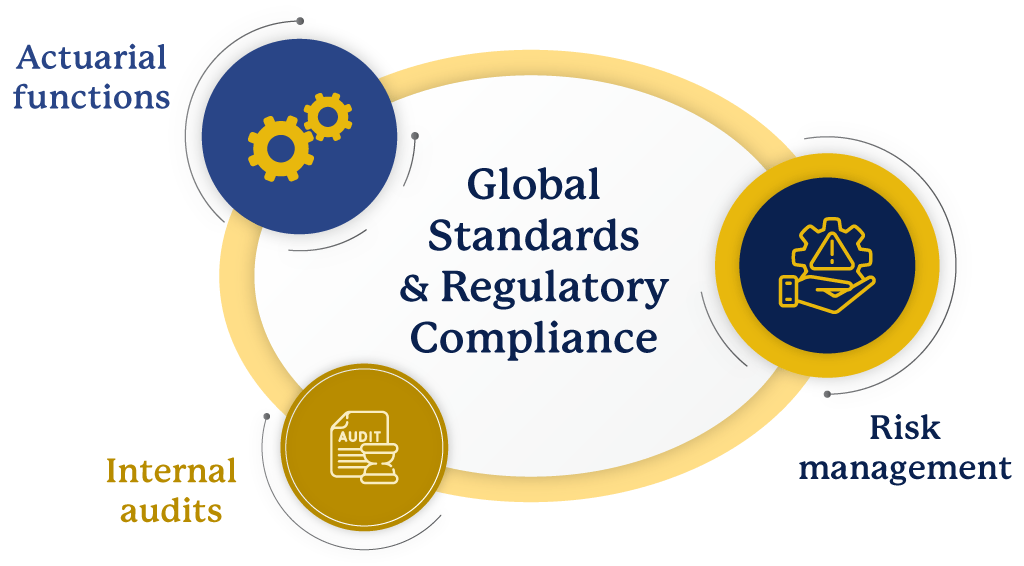

Risk & Compliance

Regulators are inspecting insurance service companies more closely. The complexity is compounded by the industry’s dependency on outdated systems and growing data volumes. Organizations need to upgrade their IT infrastructures and use technologies such as machine learning, artificial intelligence, data & analytics and cloud to tackle compliance concerns. Iris ensures that our InsurTech services support risk management, actuarial functions and internal audits adhere to necessary global standards and regulatory compliance.

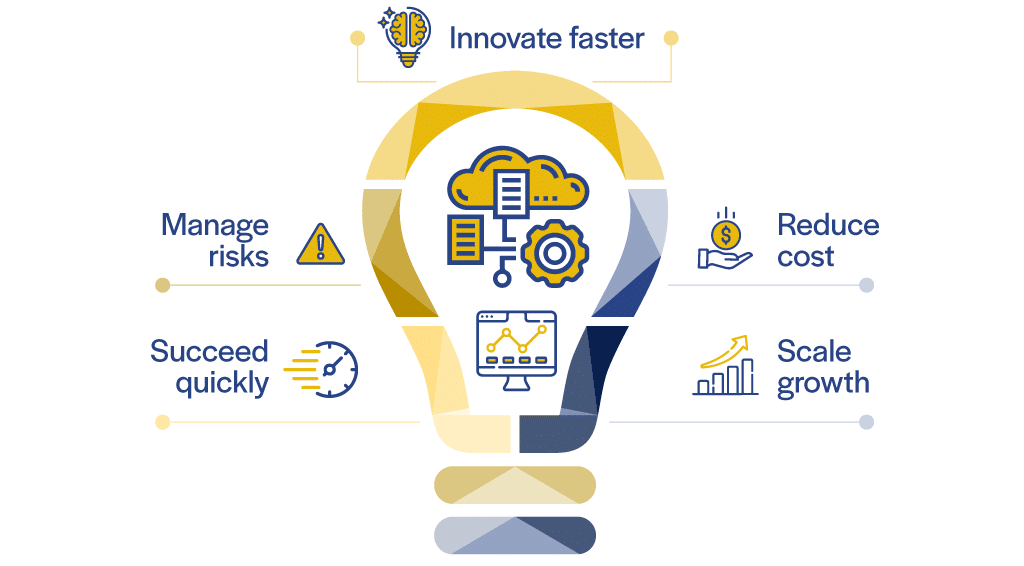

Amplify Business Competencies

Many insurers have been very measured and cautious in launching new products; and concerned about the ROI given the significant upfront costs to modify underwriting, claims, billing systems, and the infrastructure. With the ability to spin up temporary test environments and utilize capabilities in SaaS platforms built on Cloud, Data and Analytics, and Automation— insurers can try out new products. If the product is a success, they are positioned to scale quickly. If the product fails, they can shut down the environment and deliver services with minimal capital outlay.

AI & Analytics-powered Calibration

Contact Us

Thank you for getting in touch

We appreciate you contacting us. We will get back in touch with you soon.

Have a great day.

Industries

Company

Bring the future into focus.