Client

Global bank's trading operations

Goal

Resolve trading transaction breaks and related regulatory issues through expandable intra-company digital ledger system

Tools and Technologies

Hyperledger Fabric 1.4/2.2, Java 8, Go Language 1.8, Kafka, Node JS, Microservices, OpenShift, Dockers, Kubernetes

Business Challenge

A highly-manual, paper-dependent, trading and reconciliation process was causing the accumulation of a large number of daily transaction liquidity breaks, which had been cited by federal regulators and risked a billion dollar cost impact.

The lack of a robust trade audit and reconciliation process to reduce liquidity breaks and operating costs led the bank to seek an immutable system that could record and unify financial practices and be expanded to other transaction areas.

Solution

Iris solution comprised a production-ready, configurable platform using microservices and blockchain-based digital ledger architecture. It employed Smart Contracts coded with requisite business rules to facilitate front office trade booking and trade reconciliation processes.

RPA was utilized to automate data mapping and testing of transactions. Preventive controls were enabled by recording intra-company transactions at their initiation using uniform booking practices, and consequently guaranteeing the term of the trade. A multi-layered infrastructure was created to support real-time, batch streaming of differing file formats. The UX was enriched through Interactive UI and automated workflows.

Outcomes

Iris successfully introduced a global intra-company distributed ledger and trade reconciliation system that did not exist before. With self-executing contracts matching both sides of transactions prior to feeding downstream systems, the platform ensures complete integrity at the source and reduces time and cost for all transactions. The solution also achieved:

- 30% fewer liquidity breaks

- 70% improvement in operational efficiency due to the use of RPA

- 60% reduction in business-rules configuration time, due to the smart contracts

Our experts can help you find the right solutions to meet your needs.

Software transformation gets compliance for bank

Risk & Compliance

Software transformation gets FDIC compliance for bank

Client

A global investment bank

Goal

To have a unified functional validation system for FDIC compliance

Tools and Technologies

SQL Server, Sybase, Data Lake, UTM, .NET, DTA, Control-M, ALM, JIRA, Git, RLM, Nexus, Unix, WinSCP, Putty, Python, PyCharm, Confluence, Rabacus, SNS, and Datawatch

Business Challenge

The client mandated to comply with new QFC (Qualified Financial Contracts) regulations. The client also needed to perform in-depth functional validation across a revamped data platform to ensure it could timely process, review and submit to the FDIC (Federal Deposit Insurance Corp.) required daily reports on the open QFC positions of all its counterparties.

The project entailed immediate availability and processing of accurate QFC information at the close of each business day to swiftly assess data and note exceptions and exclusions for early corrective action. It also aimed to help the client meet stringent deadlines with varied report formats. Any breach or delay in compliance could attach hefty fines and reputational damage to the bank.

Solution

Iris revamped the entire system and performed end-to-end quality assurance and testing across the new regulatory reporting platform. This meant validating the transformed multi-layer database, user interface (UI), business process rules, and downstream applications.

We identified and solved workflow design gaps affecting data reporting on all open positions, agreements, margins, collaterals, and corporate entities, thus enhancing the capability for addressing irregularities. Our experts established an integrated and collaborative system, commanding transaction and reference data within a single platform by incorporating 166 distinct controls pertaining to data completeness, accuracy, consistency, and timeliness within a strategic framework.

Outcomes

Our quality assurance and testing solution delivered the following impacts:

- Faster and more efficient internal analysis with highly accurate QFC open positions

- 100% compliance with timing and format of required daily QFC report submissions to the FDIC

- Significant decrease in exceptions before the platform went go-live and critical defect delivery drastically reduced post-implementation

- An intuitive UI dashboard reflecting the real-time status of critical underlying data volumes, leakages, job run, and other stats

Our experts can help you find the right solutions to meet your needs.

Platform re-engineering for operational efficiency

Client

One of the top 20 brokerage banks in North America

Goal

Modernize an existing, licensed data platform to meet the increasing volume of transactions and product offerings

Tools and Technologies

Python, Core Java, Oracle, ETL Framework, Apache Zookeeper, Anaconda, Maven, Bamboo, Sonar, Bitbucket

Business Challenge

The client had a licensed data platform for enterprise-wide risk and compliance operations. Spiked volumes with various financial product offerings and trades were restricting the processes and limiting the analytical capabilities on the existing platform.

The system upgrade was required to support related, complex credit risk calculations. These calculations serve as a ground for several thousand bankers/ traders to make loan and investment decisions for customers. System modernization would also cater to the internal transaction and regulatory reporting requirements.

Solution

Iris system re-engineering experts designed and implemented a scalable and highly configurable data extraction platform having global data architecture. This ETL framework-based platform enables faster, more efficient onboarding, consolidation, and processing of the numerous variable product and trading data input sources.

The re-engineered platform was enabled with value-adds and tools to automate, tabulate, compare, reserve, validate and test data. We integrated the data extraction platform seamlessly with downstream risk applications and system adaptability to accommodate operational/business needs.

Outcomes

Our data platform re-engineering solution enabled the client to achieve enormous benefits, including user experience, data quality, and risk management capabilities. Key outcomes of the solution constitute:

- Quicker, real-time configuration and execution of 500+ jobs for loading trade feed

- Downtime reduced to a minimum even during the trade reference data changes

- 15% faster onboarding of the new feed or data source

- Nearly 20% faster throughput for various critical feeds with parallel processing feature

- Reduced anomalies and duplication with improved consistency

- 35-40% savings in annual third-party platform/ module license fees

- Standardized and streamlined onboarding processes and turnaround time, scaling the operational efficiencies

Our experts can help you find the right solutions to meet your needs.

IT modernization boosts Insurance customer base

Client

A leading American Fortune 500 Insurance Services Provider, offering insurance, investment management and financial products & services across the Americas and 40 other countries

Goal

To advance business agility and customer experience through modernized business systems

Tools and Technologies

C#/.NET, JAVA, DevOps, Python, NodeJS, App Services, Managed Application Support

Business Challenge

The client’s existing business applications, systems, and support services were in stasis and not delivering the much-needed value to the insurer and end customers.

Due to the lack of enterprise application portfolio strategy, business functions were onboarding applications in a silo. The net impact was that the insurer’s revenue and market share decreased.

Longer turnaround times and outdated UI were discouraging customers. On the other hand, prospective customers were also opting for modernized options available in the market.

Solution

Iris delivered app development and managed services across Annuities, Life Insurance, Group Insurance, Retirements and the Global Enterprise Service groups that decide the platform for all business units. Our services spanned around Enterprise Collaboration portal, Financial Wellness platform, Mutual Fund platform modernization, Oracle EBS development and support, and Retirement Annuities platform management.

We also executed a scaled Agile program and ran multiple Scrums within the enterprise development and support landscape. Iris tech experts established DevOps and scaled Agile Framework within the client organization and enabled a team of over 150 professionals globally to support business operations 24X7.

Outcomes

Iris has been working around the application portfolio for over three years. We have helped the client deliver an exceptional experience to employees and end customers through active service support. Key outcomes of the delivered solution included:

- Infrastructure availability increased to 99%

- Optimized maintainability reduced the KYC process time by 75%

- Customer response time cut down by around 40%

- Promoter score incremented from 5 to 9 out of 10

- Customer retention improved by nearly 80%

- Customer acquisition increased by 65%

Our experts can help you find the right solutions to meet your needs.

SFTR solution strengthened market leadership

Risk & Compliance

Securities financing transactions regulation compliance made easy

Client

A leading provider of market data and trading services

Goal

Support complex regulatory reporting with automated solution

Tools and Technologies

Java, Spring Boot, Apache Camel, CXF, Drools BRE, Oracle, JBoss Fuse, Elasticsearch, Git, Bitbucket, Sonar, Maven

Business Challenge

The client offers an automated, integrated solution to its clients in the European Union (EU) for complying with the Securities Financing Transactions Regulation (SFTR).

Effective in recent years, SFTR requires timely and detailed reporting based on multitudes of data, systems, collateral, and lifecycle events. The voluminous data is captured from hundreds of millions of daily transactions made to multiple trade repositories registered by the European Securities and Markets Authorities (ESMA).

Non-compliance at any stage is risky, potentially very costly, for all trade counterparties, i.e., broker-dealers, banks, asset managers, institutional investors.

Solution

Experienced in diverse technologies, big data, and capital markets, team Iris developed a streamlined, end-to-end data reporting platform with complex trade matching and monitoring systems. Improving speed, accuracy, and flexibility, the new architecture supports high trade concurrency and acceptance rates with parallel processing of millions of transactions.

The delivered solution also enabled optimal load balancing and matched the reconciliation at the trade repository. Built with microservices to accommodate future scalability, standardization, data quality, and security requirements, the system implemented functional enhancements. A Unique Transaction Identifier (UTI) subsystem was also developed for sharing and matching counterparty transactions, enabling plug-and-play setup for new repositories, and supporting any changes in outbound or inbound data report formats required by ESMA or clients. Improved dashboards and search pages helped the end-users in better configuration and tracking of their transactions.

Outcomes

The nimble delivery and successful roll-out of the new SFTR platform delivered the desired strategic competitive advantage to the client for maintaining its EU market leader position. The consolidated solution also helped in:

- Generating additional revenue from extending the new reporting services to 17 firms

- Beating the industry benchmark (~91%), achieving a higher transaction acceptance rate (~97%), and match reconciliation at the trade repository

- Supporting a high throughput of 6 million transactions per hour which is scalable up to 10 million

Our experts can help you find the right solutions to meet your needs.

Accelerate your agile software development

Businesses are increasingly using cloud technologies and service-oriented architectures to deliver their products and services on digital channels. They also want those IT solutions delivered increasingly faster. In order to meet those demands, IT has adopted Agile methodology to reduce time to develop new capabilities, apply fixes and deploy them to production.

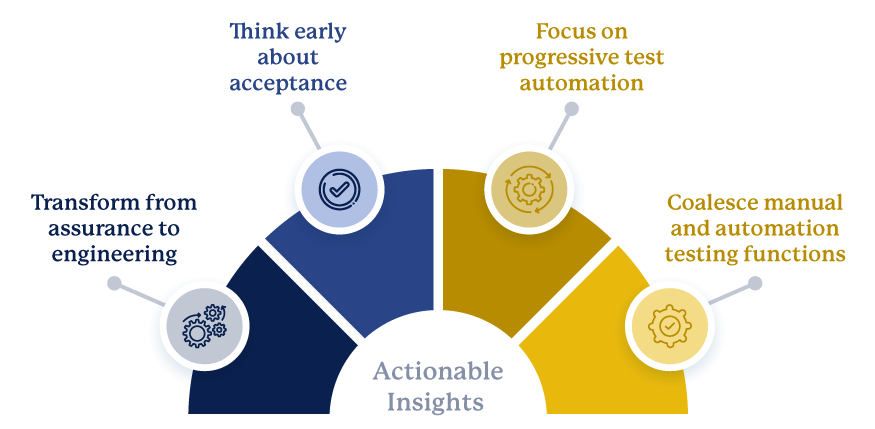

The nature of software development is transforming with more frequent releases and monolithic architecture giving way to services. Consequently, there is a greater need to ensure that overall quality does not degrade in terms of usability, reliability, scalability and performance. Clearly, as application architecture is being modernized and software is being deployed expeditiously, this method of testing will not empower IT to deliver effectively. Practical experience has given us some actionable insights to shift approaches to quality in an Agile development environment.

Challenges

We find organizations frequently face the following key challenges in transforming their approach to Quality Engineering in an increasingly Agile enterprise:

Iris Solution

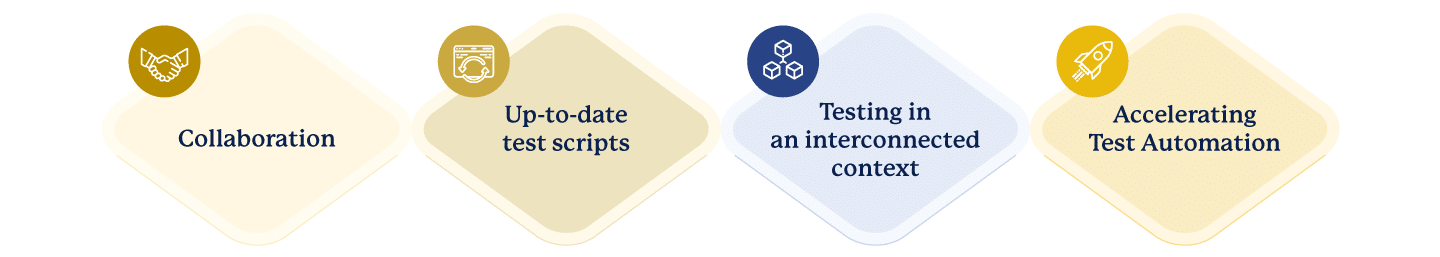

Iris solution combines using Acceptance Test Driven Development (ATDD) methodology to bring in the culture of early acceptance with continuous testing from development to production. This approach leverages DevOps and incorporates In-sprint Test Automation to accelerate between transition from a QA to a QE mindset. Our solution has a framework that enables these features:- Integration with tools that allow for developing a common understanding of requirements and specifications within the team

- Configuring a customer’s Agile development process (e.g., “Done” criteria) by integration with industry-standard tools that support code development, test scripts development and auto triggering of test execution, deployment and continuous monitoring

- Libraries with templates for gathering requirements and pre-built code for test execution, deployment and reporting

- A storehouse of reusable libraries that allow for quick access and updates of test scripts and easy integration of new components, thus reducing the maintenance burden

- A cross-referenced checklist to mark completion of all user stories, which is one of the most critical checkpoints in an Agile project

- A machine learning layer with baseline objects to support features such as self-healing and test analytics reporting. Using this facility, an Agile project can support automatic fixing of test scripts and test execution predictability, thus reducing the time and cost of custom development

Iris Automation Practice: Focus Areas and Competencies

Iris Automation Practice offers comprehensive services and solutions across competencies such as Intelligent Automation, Test Automation and DevOps Automation. Our approach introduces automation within the context of a function or industry to create seamless end-to-end processes and experiences. Our services, strengthened with machine learning and cognitive technologies, have stepped up productivity, resulting in immense benefits for our clients.Business Outcomes

- Our ATDD framework reduces the effort of building test automation suites by 30% and cuts maintenance costs by up to 60%

- Faster delivery cycles improve collaboration, thereby reducing total cycle time by 25%

- Reusability and modularity reduce efforts by up to 25%

- Increased coverage in regression test suite by 30-40%

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchCloud transformation increases business agility

Client

A non-profit global organization responsible for developing and maintaining standards, including barcodes with over 115 local member organizations and over 2 million user companies

Goals

To deliver MVPs in shorter cycles, reduce Mean Time for Ticket Resolution (MTTR), and lower the total cost of ownership

Tools and Technologies

C#/.NET Core, Python/DJango, NodeJS/Express, Azure WAF, Azure APIM, App Services, Azure Kubernetes Service, Azure Monitor, and Application Insights

Business Challenge

The client had a suite of legacy applications to generate barcodes that are scanned globally over 6 million times a day.

These applications were built on monolithic architectures using heavy-weight application servers and outdated technologies. This architecture was causing long development cycles, making the organization less competitive. Developers’ productivity was also dropping due to high technical debt.

Solution

Azure cloud offered some of the foundational features like container orchestration, app engine, integration, API gateway, monitoring and others, making cloud-specific modernization a natural choice.

Modernization strategy involved reverse engineering of on-premise applications, domain-specific grouping the product backlogs by, adopting domain-driven design, and using open source cloud-friendly software with CI/CD pipeline. We transformed the applications to a .NET core framework using cloud-native design principles on Azure cloud. The solution was developed using Azure App Services, front door and service bus following the agile development approach with two-week sprints.

Outcomes

- Reduction in Mean Time for Ticket Resolution (MTTR) by 30%

- Increase in application and infrastructure uptime to 99.9%

- Real-time visibility of application and infra metrics

- Enabled bi-weekly MVP delivery

Our experts can help you find the right solutions to meet your needs.

Anti-money laundering software saves $1M

Client

A top 5 global bank

Goal

Create a unified platform for anti-money laundering functions, analytics, and compliance implementations

Tools and Technologies

Angular 5, Java, Open Shift, and DevOps

Business Challenge

The client expanded its fraud and anti-money laundering (AML) monitoring functions, involving multiple lines of business and 15,000 employees. The scaled system led to the lack of standardization of frameworks and resultant adoption of disjointed, manual-intensive, and high-cost AML technology. The ongoing disconnect hindered the efforts of automating, consolidating and implementing AML functions, enterprise analytics, and regulatory compliance efficiently throughout the organization.

Solution

Iris optimized existing operations and technology investments by developing and implementing a unified point of access for the discrete AML functions, featuring micro-front-end architecture. Engineered to be horizontally scalable through containerization with common authentication and authorization gateways, the single user interface (UI) allows onboarding and control of multiple extended AML functions, including visualization of metrics.

Outcomes

The solution amplified efficiencies and reduced costs through the automated system and seamless exchanges of information. Significant outcomes included:

- Hassle-free transition from multiple to a single UI

- Unified, streamlined user experiences with more effective sessions

- Creation of standardized deployment procedures for AML rules and applications

- Saving of nearly $1M on infrastructure costs

- Reduced infrastructure maintenance time

- Frictionless migration of applications to the cloud

Our experts can help you find the right solutions to meet your needs.

Reporting transformation with data science and AI

Client

One of the world's leading bank

Goal

Improve efficiency in disclosure and reporting

Tools and Technologies

Python – SciPy, Pytesseract, NumPy, Statistics

Business Challenge

The client relies upon a centralized operations team to produce monthly net asset value (NAV) and other financial reports for its international hedge funds — from data contained in 2,300 separate monthly investment fund performance reports. With batch receipts of rarely consistent file formats — PDF, Excel, emails, and images — the process to read each report, capture key info, and create and distribute new metrics using the bank’s traditional tools and systems was highly manual, time-consuming, error-prone, and costly.

Solution

Iris developed a Data Science solution that rapidly and accurately extracts tabular data from thousands of variable file documents. Using a statistical, AI-based algorithm featuring unsupervised learning, it auto-detects, construes, and resolves issues for every data point, configuration, and value. Complex inputs are calculated, consolidated, and mapped as per predefined templates and downstream business needs, efficiently generating numerous, distinct, and required period-end financial disclosures.

Outcomes

The high solution accuracy helped the client’s global NAV reporting team significantly improve precision, efficiency, quality, turnaround time, and flexibility. The delivered solution contributed to:

- 90 - 95% reduction in operational efforts

- 99% accuracy in processing variable inputs

- Zero rework effort and cost

Our highly customizable and scalable solution can be seamlessly integrated with existing reporting applications and MS Outlook while accommodating additional volumes, report types, and business units.

Our experts can help you find the right solutions to meet your needs.

Powering shop floor efficiency with data analytics

Client

A leading diesel engine manufacturer

Goal

Reduce bottlenecks on the production line that arise from last-minute changes to orders and ensure compliance with build instructions

Tools and Technologies

Windows, SQL Server, C#, .NET, ESB, HTML5, Angular, GitHub, JIRA, Visual Studio, and WebStrom

Business Challenge

A diesel engine manufacturer based in Detroit faced frequent production delays. The cause of the inefficiency was its build book system. The manufacturer used a printed build book to communicate the specifications of the engine being built to the production floor. But, often after the book was sent to the shop floor, the manufacturer had to make changes to specifications.

In such cases, those working on the production line would not be able to use the printed build book. Waiting for a reprinted book would halt production. As a result, the changes were usually communicated outside the manual and assumed to be followed. If the new specifications weren’t followed, they would be discovered only in quality assurance, leading to a loss of time and dollars.

Solution

The client wanted a solution to resolve bottlenecks created by the printed build book and ensure compliance with build instructions. Ideally, the build book is dynamically pushed onto a handheld device assigned to the shop floor. The system would allow managers to update the specifications in the build book on the fly and alert the production team to the changes.

The device would also communicate the status of production to managers. For example, they would know which work center is working on an engine so that relevant pages of the build book could be updated and displayed to those work centers.

Iris custom-built an application that allowed real-time updates of the build book. It was designed to push the build book to work center operators on V10 devices (RFID transponders) with screen sizes ranging from 3 inches to 10 inches. The solution included a consolidated dashboard that provided the management near real-time visibility of work centers and the status of the engine production.

Outcomes

During Phase 1 of the project, we deployed 250 V10 devices. After a pilot run of four weeks, the client stopped printing build books; the handheld devices with our application were a superior alternative.

The solution helped eliminate printing costs and allowed the manufacturer to accommodate last-minute changes in specifications without disrupting production.

Our experts can help you find the right solutions to meet your needs.

Industries

Company

Bring the future into focus.